New Employee

Introduction

Welcome to County employment! Whether you are just starting out with saving for retirement or have retirement savings from another employer, the information on this page can help you get started with the County’s Deferred Compensation plans.

Tools For Getting Started

What does it take to get started on your retirement savings journey? Only a few minutes! The ‘Get Started‘ slide deck can help you get on the right path and begin your journey.

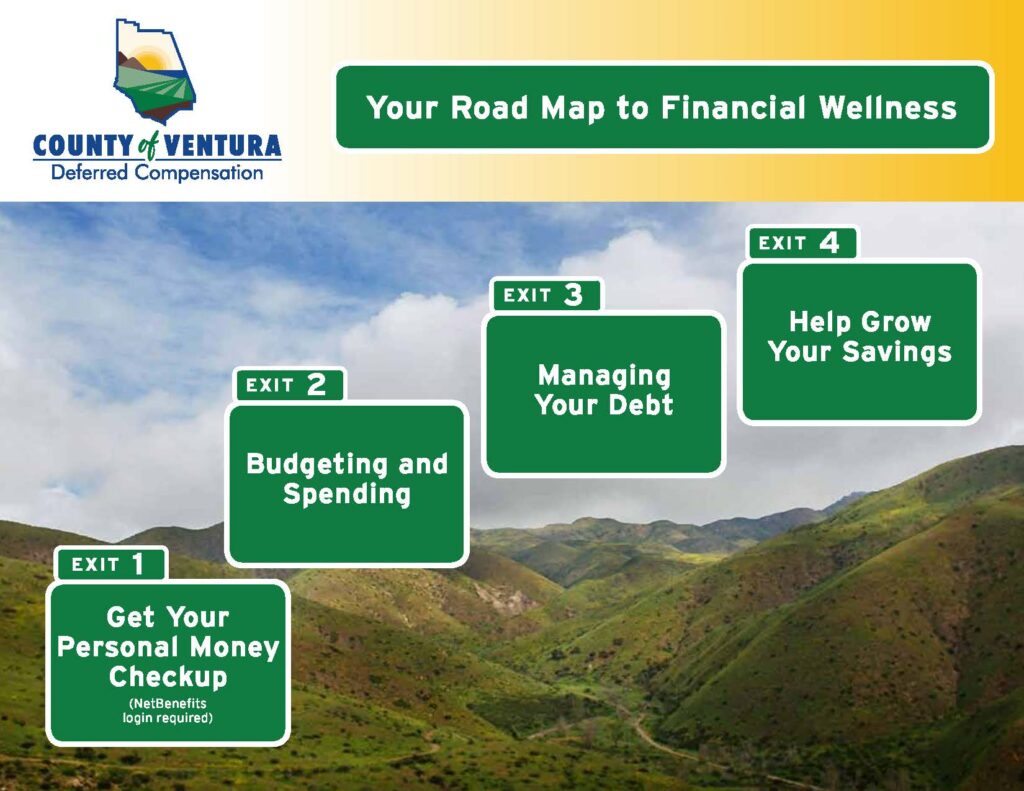

Your Road Map to Financial Wellness is a comprehensive, interactive pdf that helps you with the building blocks of sound financial habits and practice.

Road Map topics include:

- Your Personal Money Checkup

- Budgeting and Spending

- Managing Your Debt

- Growing Your Savings

The Importance of Designating your Beneficiaries

Beneficiary designations allow your assets to pass directly to whomever you designate in the unfortunate event of your passing. Your beneficiary designation will save your loved ones the costs and time involved with the probate process. In some cases, more value passes by beneficiary designations than under a will.

Beneficiary designations are easy to make and relatively easy to change. To designate or change your beneficiaries, log in to your NetBenefits account.

Consolidate Your Retirement Savings

If you have other retirement savings plans from a previous employer, consolidating your funds is a great way to maximize the compounding power that a larger balance can yield. You are permitted to roll over eligible pretax contributions from another 401(a), 401(k), 403(b), or governmental 457(b) retirement plan account, or eligible pretax contributions from individual retirement accounts (IRAs). Rollovers from Roth and after-tax sources are not allowed. A Fidelity Financial Workplace Consultant is available to assist with rollovers into the County plans. Schedule a complimentary, virtual appointment with a Fidelity Financial Workplace Consultant or call 800/343-0860.

Be sure to consider all your available options and the applicable fees and features of each before moving your retirement assets. Review “How to Roll Over a 401(k)” before you make your final decision.

Did You Know?

You can enroll in the 401k and/or 457 plans after you receive your first paycheck.

There is a County match waiting for you! Take a look at the Plan Year brochures to view the match for your bargaining unit.

Log on to NetBenefits to create your account and enroll! Or call Fidelity at 800-343-0860